Are you a First Bank user and have been surfing the net on how to transfer money from your Bank account to no avail? Do you need the First bank USSD code for the mobile transfer of airtime and data? If yes, kindly read on.

Without any doubt, the First Bank of Nigeria is one of the most patronized financial institutions in the country, it earned people’s trust and gained its reputation by rendering outstanding customer service to both their seasoned and prospective subscribers.

Hence, the bank like other modern-day banks is dancing to the tune of technology advancement by rendering mobile transfer of money, airtime, data, and more via their mobile as well as the USSD code.

While this article on First Bank transfer code is going to be discussed in a different segment, you must note that you will need to generate a token known as a transfer PIN from the bank to enjoy any of these mobile transfer services.

That being said, *894# is the code for First Bank transfer. With this transfer code, there is no task or bank transaction in existence that you cannot complete from your comfort zone.

Related: Eco Bank Ussd Code | How to use Ecobank Transfer Code

Features Of First Bank USSD Code

Without any doubt, the following are what you tend to enjoy by using the first bank USSD code:

- Your transfers will be secured;

- It is very quick;

- It enhances convenience and comfortability;

- It makes banking easier;

- No internet connection required;

- You can pay your bills with it;

- You can buy airtime using the firstbank code;

- You can create an account with First Bank using the USSD code, etc.

These among others are some of the advantages you stand to gain by using the First Bank mobile or internet banking services in Nigeria.

What is First Bank Transfer Code?

The First bank transfer code is a 3-digit number used for making or completing any bank transaction from the comfort of one’s home by simply dialing *894# on the phone dialler.

This code doesn’t require any internet or app to be operational as it’s designed in other to make things less complicated for their users. According to First Bank, this kind of mobile transaction is called “Quick Banking”.

And it is only meant and designed for their registered customers to aid them in doing any kind of impromptu task without necessarily going down to the bank. With it, First Bank customers can transfer money easily from their bank to any bank, recharge their phone, transfer airtime, data, and lots more.

First Bank USSD Code Registration Requirements

To enjoy the short code services, the following are the important things or considerations you need to furnish:

- An active First Bank of Nigeria bank account;

- An active phone number;

- Linking the phone number to the First Bank account; and

- A debit card.

How To Generate First Bank Transfer PIN Code.

To enjoy the First Bank Quick Banking scheme, it’s expected of you to generate a transfer PIN that will be known to you only and to the exclusion of any other person.

This is important in other to secure your account away from fraudsters or a third party who might want to transfer money from your bank wallet in your absence.

So to generate the first bank transfer PIN, you must have open an account with the First Bank and if you haven’t, kindly walk into any of their branch situated in your community or anyone close to you.

After you must have registered an account with them, then follow this step by steps approaches, below, on how to generate the First Bank USSD code on their Quick Banking service:

Step 1: Dial *894*0#

Go to your phone dialler, press *894*0# and then send, you will see pop-up instructions on your screen, read it and move to the next step.

Step 2: Choose your preferred debit card.

Having sent the dialed ussd code, you will see a list of covered debit card numbers that are linked to your account on your phone screen. Then, choose your preferred debit card.

Step 3: Enter your debit card PIN

Once you’ve selected your ideal debit card, other pop-up instructions will be shown to you telling you to enter the 4-digit PIN (Personal Identification Number) of the chosen debit card.

Also Read: Access Bank Salary Structure: How Much Does An Access Bank Staff Earn?

Step 4: Create a new PIN

At this stage, you will be asked to create a new but unique and easy-to-remember 4-digit PIN to serve as your First bank transfer pin.

Immediately you submit your transfer pin, you will get a popup message congratulating and telling you that your phone number has now been activated for the First Bank USSD Code Quick Banking Service.

Be that as it may, once you’ve successfully generated a transfer PIN code using an easy to remember digits, you can now perform any kind of transfer operation on the First Bank mobile app or using the USSD channel.

How To Transfer Using The First Bank USSD Code.

Knowing the first bank transfer code and generating the transfer PIN is not enough in your sojourn to use the First Bank Quick Banking Service. You need to learn how to carry out all sorts of transfers using the USSD code.

And as it has been said earlier that the Firstbank transfer pin will enhance you to transfer funds or money to another First bank or a different bank entirely, and its simplicity also allows you to perform other major tasks or transactions too.

Hence, as a First Bank account holder who is about to top-up his mobile line or that of his beloved sister directly from his phone, kindly follow the below step.

Step 1: Dial *894*amount#

As easy as this is, kindly dial the First bank transfer code, follow by the asteric sign and the amount to be purchased, and then the naira sign. Like this *894*500# from your mobile phone.

When dialed, you will see two options displayed on your phone screen to choose from:

Quick Banking: Follow the prompts to see the listed services available only for First Bank account holders.

Firstmonie: For e-wallet transactions and the product is available to anybody. Be it a First bank account holder and a non-account holder.

From these two options, you know which to choose from and of course, that’s option one; Quick Banking.

How To Transfer Money From First Bank to other banks

To transfer funds from your First bank account to another First bank user or any other banks in Nigeria directly from your phone using the USSD code, kindly follow the below steps.

Note that this method is actually the simplest and easiest way to perform this bank transaction as it can be done using a mobile phone (no internet connection required) anytime and anywhere.

Now, let’s go…

Step 1: Dial the USSD service code.

To carry out any sort of money transfer from First Bank to First Bank or from the first bank to another bank, simply dial *894*Amount*Account Number#. Like this: *894*10000*XXXXXXX#

Step 2: Select beneficiary bank.

Once you dial the above USSD code, you will see a prompt telling you to select the particular beneficiary bank. Here, you will see a list of available banks in Nigeria to choose from.

Step 3: Confirm the amount.

You will be asked to confirm the amount you will be sent down to the beneficiary. Verify if you’ve entered the correct figure and make the necessary correction if any.

Step 4: Enter Beneficiary name

Since you must have known the name of the person you will be transferring the money to beforehand, enter the name of the person in the provided box and if you don’t, call the person to ask for his name.

Step 5: Enter your transfer PIN

At this stage, you are almost done with the transaction but you must enter your first bank transfer PIN correctly for the transaction to be successful. This is necessary to avoid a third party from transferring money from your account without your permission.

Step 6: Select the account to debit from.

This is the last step on how to transfer money from the first bank to another bank. Select the account you want First Bank to debit you from and wait for the transaction to be completed.

You will receive a debit alert afterward containing the amount you transferred, the name of the beneficiary, and your remaining balance.

This is simple, right? Yes, all that is needed to complete a mobile transfer using the firstbank USSD transfer code is the phone number you used for opening an account with First Bank.

Related: Fidelity Bank Salary Structure; How Much Do Fidelity Bank Staff Earn?

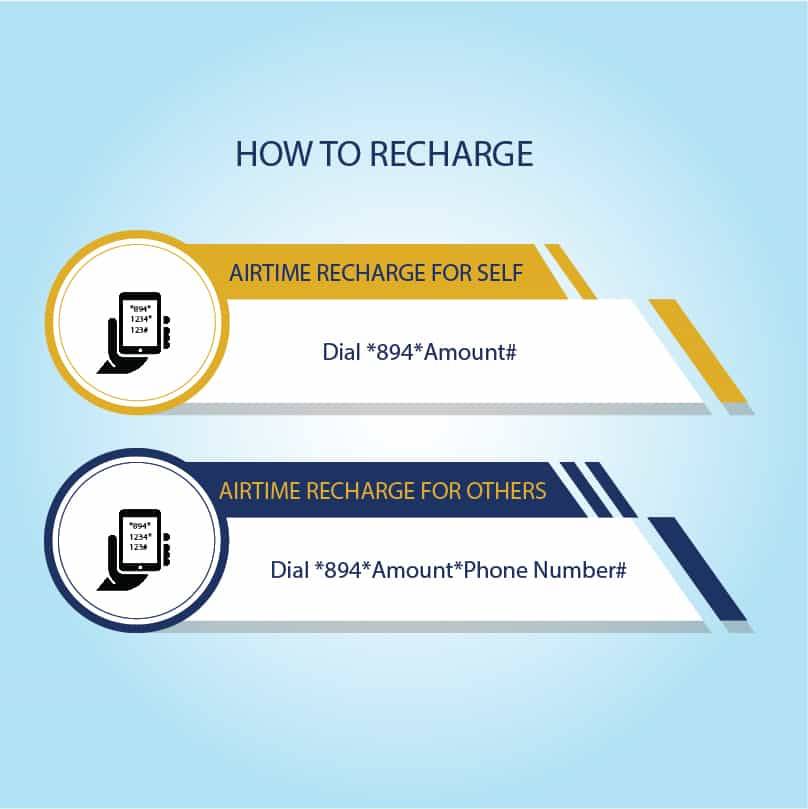

How To Recharge Using First bank Code

If you want to recharge or buy airtime using the First bank shortcode for yourself or a third party, please follow the below steps:

- Airtime recharge for yourself

Step 1: Dial the firstbank USSD code

Since you will be buying the airtime for yourself, just dial *894*Amount# on the sim card you used to register with Firstbank and enter the PIN you generated.

Like this: dial *893*500# and send, you will be asked to enter your PIN (XXXX) and send it. This will automatically make the airtime purchase for you since it’s on your registered SIM card.

Alternatively,

Dial the First Bank short code *894*Amount#, and then send;

- Enter your transfer PIN;

- Press the ok button; and

- Follow the pop-up instructions on your phone screen to purchase the airtime.

- Airtime recharge for a friend.

To purchase airtime for another person like your family and friends or if you want to recharge your other SIM card, follow the Step below:

Step 2: Dial the USSD code

Since you will be recharging a SIM card other than the one you used for your First bank account registration, simply dial *894*Amount*Phone number# and send, after which you will be asked to enter your first bank transfer PIN code.

Like this: *894*200*081XXXXXXXX#

Alternatively;

Dial *894# on the mobile number that is linked to your FirstBank account;

- Select the amount of airtime you want to transfer;

- Enter the recipient phone number;

- Enter your PIN, and send.

Please Note: First Bank account holders cannot transfer more than N100,000.00 per day and equally, the highest amount of airtime they can buy is N10,000.00 per day.

How To Check Your First Bank Account Balance With A USSD Code.

One of the reasons why First Bank like other banks in Nigeria introduced their Quick Banking Services is comfortability and customer convenience. So if you want to check your account balance using the code for the first bank transfer, do look at the below illustration:

Just dial *894*00# on the sim card you used to registered your first bank account and send it. You will receive a pop-up message showing you your current account balance. As simple as that.

First Bank Shorts Code For Different Transactions

You don’t have to visit any first bank physical office or other bank outlets to perform and complete some transactions. For the record, some of these transactions can be done in your office, at home, at the mall, etc., using your phone and the number you use to register with First Bank.

The most used First Bank USSD codes are as follows:

- First Bank transfer PIN registration short code: *894*0#

- Airtime recharge (for self): *894*Amount#

- Airtime recharge (for others): *894*Amount*Number#

- First Bank money transfer code: *894*Amount*Account number#

- First Bank short code for checking account balance: *894*00#

- First Bank Mini-account statement short code: *894*Account number#

Why going down to a bank to queue for hours when you can actually sort yourself out with the above highlighted First Bank transfer codes couple with your generated 5-digit transfer pin?

Trust me with these shortcodes, you can conveniently carry out important transactions everywhere and anytime with your cell phone.

Conclusion

In conclusion, the First Bank transfer code (*894#) is a quick, secure and convenient way to perform lots of banking transactions in ones comfort zone. Although the use of this USSD code to complete a task attract a token as charges, yet it probative value outweigh the charges.