Mastering a trading strategy is akin to a fine art, requiring not just an understanding of the markets but a harmonious blend of discipline, continuous learning, and the ability to adapt to ever-changing conditions.

Navigating through the volatile waves of cryptocurrencies, the intricate dynamics of Forex, or the diverse landscape of stocks and equities requires foundational principles that elevate your trading strategy from novice to expert levels. In this exploration, we delve into five pivotal ways to refine and master your trading strategy, setting the stage for sustained success in the financial markets.

Embrace a Holistic Market View

Expert traders distinguish themselves through their ability to not just focus on isolated market indicators or datasets; they develop a comprehensive and nuanced view of the markets. This holistic approach involves a deep dive into various factors influencing market movements, including but not limited to economic indicators, political events, societal shifts, and psychological factors that affect market participants’ behavior.

For instance, a Forex trader might analyze the implications of interest rate decisions across different countries, inflation reports, employment figures, and geopolitical tensions, piecing together how these diverse elements interplay to affect currency values. Similarly, a stock trader would look beyond company earnings to consider industry trends, regulatory changes, and broader macroeconomic indicators that could signal shifts in market sentiment.

To cultivate a broad market perspective, regularly review a diverse range of financial news sources, economic calendars, and market analysis reports. Embrace platforms that offer integrated news feeds and analysis tools, enabling you to effectively synthesize and act on information from multiple perspectives. Cultivating a routine that includes scanning the global news first thing in the morning can provide early insights into market trends and potential volatility.

Refine Your Technical Analysis Skills

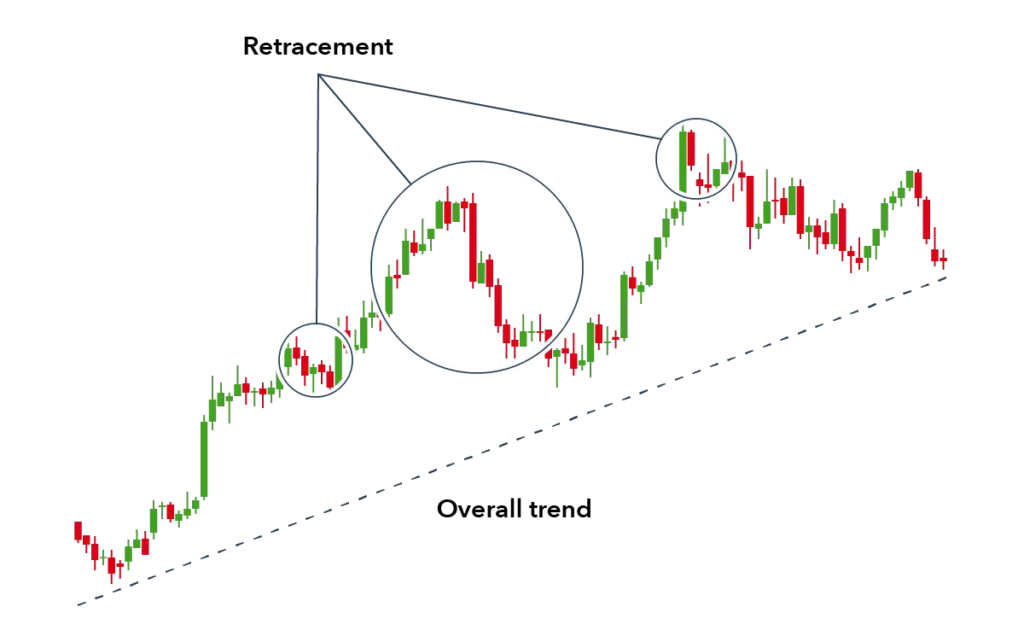

Mastering technical analysis is a journey of continuous learning and practice. Beyond the basics, understanding the nuances behind chart patterns and indicators demands rigorous study and application. For example, while many traders might recognize a head and shoulders pattern, an expert understands the psychological and market dynamics that give rise to such patterns and can thus anticipate potential market moves with greater accuracy.

Similarly, proficiency with tools like the RSI or MACD not only involves recognizing overbought or oversold conditions but also understanding how these indicators can provide insights into market strength or weakness within broader trends.

Set aside dedicated time each day for chart study and practice. Begin with focusing on a single asset class or market to deepen your understanding before expanding to others. Utilize simulation tools or paper trading to test your observations and hypotheses without financial risk, allowing for a practical application of technical analysis theories in a controlled environment.

Develop a Disciplined Trading Routine

A disciplined trading routine is the backbone of successful trading. This routine encompasses not just the active trading hours but also the crucial preparation before the market opens and the reflection after it closes. Pre-market preparation involves reviewing overnight news, analyzing pre-market activity to gauge the day’s potential market direction, and identifying potential backtesting trading strategies. Post-market review, on the other hand, offers the opportunity to assess your trading decisions, understand what worked and what didn’t, and refine your strategy accordingly. This disciplined approach ensures that each trading day contributes to your growth and learning as a trader.

Craft a detailed trading plan that includes not just your entry and exit criteria but also your routine for market analysis, trade review, and self-assessment. This plan should be a living document, regularly reviewed and adjusted based on your trading experiences and evolving market understanding.

Implement Advanced Risk Management Techniques

Advanced risk management is what separates seasoned traders from the rest. Understanding correlations between different trades and assets can significantly enhance your risk management strategy. For example, being aware that certain currency pairs move in tandem or inversely can help in diversifying or hedging your Forex trades. Similarly, in the stock market, knowing how to balance your portfolio across different sectors or using options for hedging can protect your capital from unforeseen market downturns.

Dive deep into learning about correlation and volatility-adjusted position sizing. Experiment with hedging strategies in a simulated environment to understand their impact on your overall risk profile. Keeping a detailed journal of your risk management practices and their outcomes can be incredibly enlightening and help refine your approach over time.

Stay Agile and Ready to Adapt

The financial markets are in a constant state of flux, driven by innovation, regulatory changes, and how countries’ economies stack up against each other. An expert trader remains perpetually curious, always on the lookout for new tools, assets, and strategies that can enhance their trading approach.

This agility is not just about reacting to changes but proactively seeking out new opportunities for growth and learning. It involves staying abreast of technological advancements in trading platforms, exploring emerging markets or sectors, and being open to revising your trading style in response to new market realities.

Commit to lifelong learning by setting aside time each week for education—whether through online courses, trading seminars, or exploring new analytical tools. Join trading communities or forums where you can exchange ideas with other traders, gaining insights into different strategies and perspectives.