The Volatility Index (VIX) is a crucial tool in understanding market expectations of volatility, particularly in the cryptocurrency sphere. As cryptocurrencies are known for their price volatility, the VIX provides valuable insights for traders to assess risk and make informed decisions. In addition, if you are looking for a website that helps people learn about investments by connecting them with investment education companies that can help them receive the right information, you may visit bitcoin-bankbreaker.

What is the Volatility Index (VIX)?

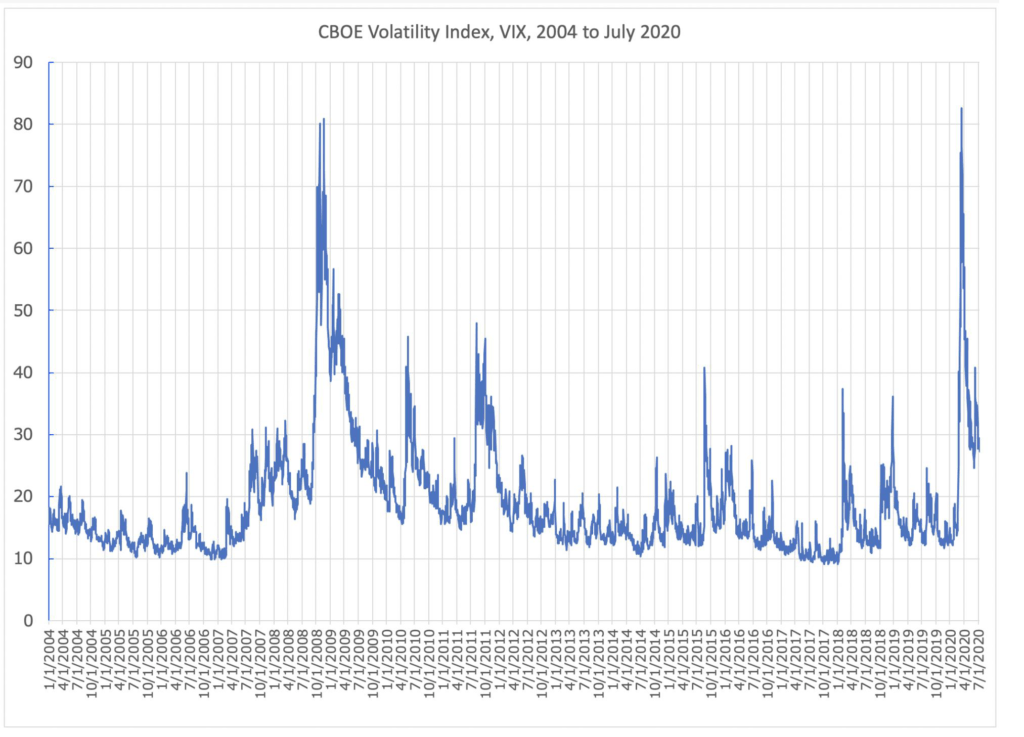

The Volatility Index (VIX) is a measure used to gauge the expected volatility in the stock market over the next 30 days. It is often referred to as the “fear gauge” because it tends to rise during times of market stress and uncertainty. The VIX is calculated based on the prices of options on the S&P 500 index, which is a measure of the stock performance of 500 large companies listed on stock exchanges in the United States.

The VIX is calculated using a formula that takes into account the prices of a range of call and put options on the S&P 500 index. These options are used by investors to hedge against or speculate on changes in the stock market. By analyzing the prices of these options, the VIX can provide an indication of how much volatility is expected in the stock market in the near future.

Traders and investors use the VIX as a tool to help them make decisions about their investments. A high VIX value suggests that there is a greater expectation of volatility in the market, which may lead traders to take a more cautious approach to their investments. Conversely, a low VIX value suggests that there is less expectation of volatility, which may lead traders to take a more aggressive approach.

Overall, the VIX plays a crucial role in helping traders and investors gauge market sentiment and make informed decisions about their investments.

The Importance of the VIX in Crypto Trading

The Volatility Index (VIX) is also increasingly important in the world of cryptocurrency trading. Cryptocurrencies are known for their high volatility, with prices often experiencing large swings in short periods. This makes them attractive to traders looking to profit from these price movements.

The VIX can be used as a tool to help cryptocurrency traders gauge market sentiment and make decisions about their trades. A high VIX value in the cryptocurrency market may indicate that traders are expecting increased volatility, which could lead to larger price swings. Traders may use this information to adjust their trading strategies accordingly.

Additionally, the VIX can also provide insights into market sentiment. A rising VIX value may indicate that traders are becoming more fearful, which could lead to a sell-off in the market. Conversely, a falling VIX value may indicate that traders are becoming more optimistic, which could lead to a rally in prices.

Overall, the VIX is an important tool for cryptocurrency traders to help them navigate the volatile cryptocurrency markets and make informed trading decisions.

Key Factors Influencing the VIX in Crypto Trading

Several key factors can influence the Volatility Index (VIX) in the cryptocurrency market. One of the primary factors is market sentiment. If traders are feeling optimistic about the market, they may be more willing to take on riskier trades, which could lead to increased volatility. Conversely, if traders are feeling fearful, they may be more likely to sell off their positions, which could lead to decreased volatility.

Regulatory developments can also have a significant impact on the VIX in the cryptocurrency market. News of regulatory crackdowns or new regulations can lead to increased uncertainty among traders, which could lead to increased volatility. On the other hand, regulatory clarity can help reduce uncertainty and lead to decreased volatility.

Technological advancements can also influence the VIX in the cryptocurrency market. For example, the development of new trading algorithms or the launch of new cryptocurrency exchanges can lead to changes in trading behavior, which could impact volatility.

Overall, a combination of market sentiment, regulatory developments, and technological advancements can influence the VIX in the cryptocurrency market and affect trading strategies.

Conclusion

In conclusion, the VIX plays a vital role in cryptocurrency trading by helping traders gauge market sentiment and make informed decisions. By understanding the factors that influence the VIX and how to interpret its values, traders can navigate the volatile cryptocurrency markets more effectively, ultimately improving their trading strategies and outcomes.